READY TO BUILD YOUR

+$100K INVESTMENT PORTFOLIO?

6 HOURS TO SIX-FIGURES

the only investing course you'll need

DOES THIS SOUND LIKE YOU?

- You want to invest but you don't know where to start

- Your mutual funds with the banks haven't grown much so you're just investing the bare minimum, like $50 per month (but you know you can do better)

- You're not fully trusting of the banks because they have their own agenda, but you don't know where else to go

- You're overwhelmed with information on YouTube, Facebook groups, TikTok, Instagram, and other social media channels

I CAN HEAR "YES" THROUGH YOUR COMPUTER!

I totally get it.

I had ZERO support with my investments when I started out – and there was A LOT less information back then.

I didn’t have enough money to get the attention I wanted and needed at the banks or with a professional advisor.

So I had to “trial and error” it until it worked.

I lost money on stocks from listening to people's "hot tips" and from the "peasant stock trap".

The trap where people think just because a penny stock is $0.40 it is cheap and that it could easily go to $2.00 – so if I invest $1,000, it could turn into $5,000 and all my life problems will go away.

Except most of the time, people end up losing their entire investment.

WHICH IS WHY I CREATED THIS COURSE JUST FOR YOU

6 HOURS TO SIX-FIGURES

THE ONLY INVESTING COURSE YOU NEED

In 6 hours or less, learn the proven ME2E framework to build your own investment portfolio, like a professional, without paying the high fees for it.

Michelle’s 6 Hours to Six-Figures course was everything I needed to get started as an amateur investor! I am recommending this to all my friends and family who want to dip their toes into the finance world but are scared by the jargon. Michelle made it so easy to understand and I’ve already bought my first ETF. Run don’t walk to get this investing course for Canadians and Americans!

savannah h

FREELANCE WRITER

GET INSTANT ACCESS WHEN YOU SIGN UP.

BINGE IT ALL IN ONE SHOT AND START INVESTING!

When you're done with 6 Hours to Six-Figures, you'll have

A DIVERSIFIED PORTFOLIO BUILT

...like a professional, without paying the fees for one. You will receive the necessary information and education to become a confident investor, sifting out all the BS non-sense that's not relevant to your life or investments! No time wasted here!

CASH RETURNS

Hitting your account within months of investing...these are the dividends you receive just from investing!

the most passive wealth creation tool you'll ever have

You will this that once the wheels are running this is the most hands-off approach to building wealth. This is a "set-it and forget-it" portfolio that will grow your money over the long-term, without worrying your investments going to zero.

We get your investing mindset ready to ensure you end up in the boat of successful investors as opposed to the chronic losers in the investing game.

Whether it's a down market or a good market, you will see opportunities and learn how to manage both scenarios.

About Michelle Hung, CFA

Heyyyyyy! I'm Michelle Hung, a Senior Wealth Advisor at TriDelta Private Wealth, financial planner, and published author of two books, The Sassy Investor and Investing for Teens: How to Save, Invest, and Grow Money.

Over the last eight years, I have taught thousands of students and clients how to invest in the stock market and plan for their financial future.

I am a CFA (Chartered Financial Analyst) charter holder and Certified Financial Planner (CFP) and have spent over seven years working in investment banking and venture capital prior to starting my career in personal finance and financial education.

How did I get here?

I thought I had life figured out in my 20s - I was in a long-term relationship living downtown Toronto with my partner, along with our pup, with excellent finance jobs in Toronto.

Until one day, I was laid off from my full-time job of 7 years, the relationship had ended, and my dog got sick and passed away - so I found myself back home living with my mom and dad.

While I wasn’t prepared emotionally for these life events (I don’t think anyone ever is), at the minimum, I was financially prepared.

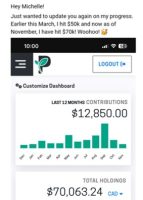

Because I was sitting on a +$120,000 investment portfolio that I could have converted into cash with the push of a button.

I had options.

I was able to take time off to heal, grieve, and rebuild my life on my own terms, on my own timeline without worrying about money.

I see too many women stuck in horrible relationships or in unfulfilling jobs because they are financially handcuffed or don’t have a dime to their name.

I went on a mission to help women become financially independent so they can live life on their own terms and build a lifetime of wealth.

Who do I help?

I help those who are looking for unbiased financial advice (I don’t sell any financial products) and want a plan for their money and investments.

Whether you’re on a debt-free journey, saving for your home purchase, accumulating wealth, or getting ready to retire and leave a legacy for your children, we have solutions for you.

I’ve helped people turn their low-returning, expensive mutual into a low-cost professional investment portfolio that will add over $400,000 to their retirement.

I’ve helped newly divorced women pay off over $25,000 within 2 years.

I’ve built financial plans for couples who want to retire before 60 years old with a $2 million investment portfolio.

I’ve helped individuals save and invest for a down payment on their first home.

I’ve helped those that just graduated to those who are in retirement. No matter what stage in life you’re in, everyone needs a plan for their money.

Happy students

Richard M.

Retiree

"Michelle is a strait shooter and give a lot of smart, innovative options about managing your own portfolio. I highly recommend it. I am 73 years old and she opened up new avenues I had never thought of before. She explains things very clearly. Really felt I was getting solid advice rather than a sales job. Thanks Michelle!"

Heather L.

Dietician

"Not only has Michelle helped me pay myself first and save money but she helped me in my process to pay off my student loans. I am finally debt free! I’ve also been good enough to have already placed more in my Roth account than all of last year, while going on multiple vacations!"

Diana H.

Director, Client Solutions

"...I was able to contribute $10,000 in savings, saw a 20% growth in my portfolio and 2.5% reduction in annual management fees. Most importantly, it gave me the financial freedom and confidence to leave my unhappy relationship, move out and furnish my own place, take up boxing, pursue a designation, and rebuild my happiness.”

6 HOURS TO SIX-FIGURES Modules

The step-by-step blueprint to follow that will make your money work for you.

Let's not forget these INCREDIBLE

BonusES

BONUS #1

BEYOND YOUR CORE PORTFOLIO

Naturally, once your portfolio is built, you’ll want to know what’s next. What else can you invest in?

Going beyond your core portfolio with other types of asset classes, including cryptocurrency (and how to invest in it strategically) and products that are NOT directly correlated with the stock market. You'll also learn how to invest in socially responsible companies.

(VALUED AT $1,500)

BONUS #2

STOCKS ON STEROIDS

What stocks should I invest in? How do I increase my returns with individual stocks?

Learn the simple 4 step framework that will help you pick winning stocks that could 10x your returns.

You will learn how to distinguish the superior stocks from the loser stocks that are more likely to go to zero!

(VALUED AT $3,000)

BONUS #3

HOW TO TURN YOUR MONEY-SUCKING MUTUAL FUND INTO A WINNING ETF PORTFOLIO

Your money has been invested with the banks for years, and you haven't seen it budge all this time. It's all thanks to these 2 PROFIT KILLERS - and you can eliminate them RIGHT NOW so your money can actually start growing.

(VALUED AT $3,000)

BONUS #4

THE 10-MINUTE PORTFOLIO MANAGER

Learn how to manage your portfolio, including all your family members, in less than 10 minutes per month.

(VALUED AT $1,000)

BONUS #5

BYE-BYE DEBT SCHEDULE AND TRACKER

Using our Bye Bye Debt Schedule and Tracker, see the end date of when you'll finally be debt-free and hit your target savings goal. It will show you which debts to pay off first and how much to allocate to each debt. You will also learn how you can pay off debt faster and save on interest costs.

(VALUED AT $1,000)

BONUS #6

CASH OVERFLOW BUDGET SYSTEM

Get access to the proven cash flow system that beats traditional budgeting methods. No more penny-pinching or keeping track of every cent of you're spending. You'll learn how you can spend freely, without going over budget while making sure your savings are on track.

(VALUED AT $1,000)

BONUS #7

FAST PATH TO CASH: HOW TO NEGOTIATE A RAISE AT WORK

When was the last time you asked for a raise? This is the fastest way to increase your income! Follow this training, along with a worksheet (including verbal and email scripts) to help you get the raise you deserve!

(VALUED AT $500)

BONUS #8

HOW TO START A SERVICE-BASED BUSINESS AT HOME IN 5 STEPS

Imagine being able to earn an extra $1,000 per month from your home by utilizing your knowledge, gifts and experiences? Learn how to start a service-based business at home by following these five simple steps.

(VALUED AT $1,000)

BONUS #9

MAXIMIZE YOUR FIRST HOME SAVINGS ACCOUNT (FHSA)

Make the most out of your First Home Savings Account (FHSA) if you're a first-time home buyer in Canada and build your six-figure down payment.

(VALUED AT $3,000)

TOTAL VALUE OF BONUSES: $15,000

WHEN YOU ENROLL,

YOU'LL GET INSTANT ACCESS TO:

6 HOURS TO SIX-FIGURES PROGRAM + BONUSES

TOTAL VALUE: $25,500

But you're paying nowhere near that much!

This course is usually $697 but I will knock off $200 and you can get all of the above for just

C$497 for a limited time only!

Don't take my word for it, hear it from others who have learned from me

"Michelle has helped me greatly and completely changed my finances. She helped direct my not only my finances, but also my attitude towards my money, investing, and saving. I look forward to applying my new found knowledge and am excited for the positive financial changes I will be obtaining."

Mariam V ● Makeup Artist

Finances have always been a little intimidating and scary for me. Growing up I always thought that working hard in school and securing a stable and well paying job was the answer.

Learning from her, I made my first investment and I have been investing ever since. I feel empowered, enlightened and educated about my finances and no longer overwhelmed by what used to be a great scary mystery to me. I highly recommend contacting Michelle and finding out how she can help you.

Maria C ● Lawyer

“Michelle went above and beyond to help me understand various concepts, and took the time to answer my questions in detail. I really appreciated her patience. She was approachable and easy to talk to."

Tiffany Y, CPA ● Finance Manager

Michelle helped me really understand how much my bank was taking from my portfolio in fees. When I first saw 2.3% I thought to myself 'that's nothing! Wow so cheap to have someone look after my portfolio for me all year around!' Michelle walked me through how easy it was to manage my own portfolio and how low the fees are for ETFs. I had no idea fees can be as slow as 0.2%. Crunching the numbers I saw that the following year I saved over $4,400 because of the lower fees. My bank would only re-balance my portfolio up to 4 times a year and now that I do this myself I've found it only takes a couple of hours per year and it's very simple. My only regret with managing my own portfolio is not starting sooner.

Sarah C ● Manager, Product Support

“Fantastic course! I highly recommend this program. It helped me become financially organized, and it got me to start investing my money according to my needs.”

Veronique W ● Flight Attendant

“This was exactly what I needed to be, thanks so much for getting me started on my road to investing and buying a home!”

Shannon P ●

faq

Absolutely! This is why I created this program - to help people that want to know how to invest and make it easy for them to understand so they become confident and feel excited to take action.

In life, the only things that are guaranteed are taxes and death! Because I can't control what you choose to do with your money, I can't guarantee the results (and I certainly can't guarantee what type of returns you'll make). But what I can say is that all the students and clients I've worked directly with have seen their money grow :)

You will have lifetime access to all the trainings! Work through the program as fast or as slow as you can, but of course, the sooner you take action, the sooner your money starts working for you, and the sooner you start building your wealth!

THIS IS THE ONLY INVESTING COURSE YOU'LL EVER NEED

Time is money, and I want more of it for you! I hope to see you on the other side!

WHEN YOU ENROLL,

YOU'LL GET INSTANT ACCESS TO:

6 HOURS TO SIX-FIGURES PROGRAM + BONUSES

TOTAL VALUE: $25,500

Disclaimer: The Sassy Investor does not provide investment advisory services, including stock advice or recommendations. The Sassy Investor is an education platform and financial coaching company engaged in the services of educating and facilitating individuals in the areas of financial planning. Articles, commentaries, presentations, investment plans and other content provided by The Sassy Investor on or through the Website are for illustrative or educational purposes only and do not constitute investment, legal or tax advice, or an offer to buy, sell or hold any security. Forecasts or projections of investment outcomes in investment plans are estimates only, based upon numerous assumptions about future capital markets returns and economic factors. As estimates, they are imprecise and hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Investing entails risk including the possible loss of principal and there is no assurance that the investment will provide positive performance over any period of time.